In the classic Disney film “Mary Poppins,” George Banks, a prominent London financier, takes his son, Michael, to the bank to convince him to deposit his tuppence instead of using them to feed the birds. After a song (and stilted dance) by the bank’s board, the chairman takes Michael’s money, creating a ruckus when Michael screams. All the customers suppose that the bank must have run out of money and demand their deposits. The bank responds by closing its doors and shutting down business, which only creates more panic throughout London as a large mob forces itself inside.

The scene, while chuckle-inducing, does highlight one of the basic weaknesses of our global financial system — how banks can bring on a financial crisis — which was the subject of research that earned this year’s Nobel Memorial Prize in Economic Sciences, awarded Monday.

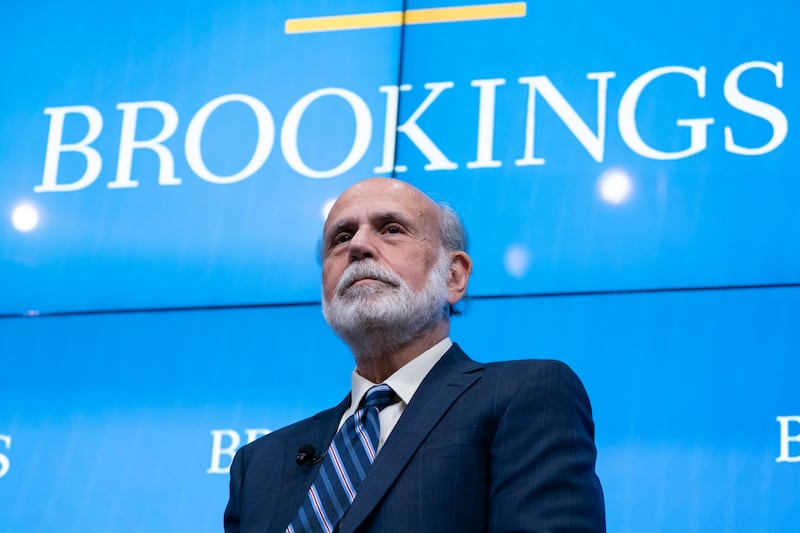

The Swedish Riksbank awarded the prize to Ben Bernanke, former chairman of the Federal Reserve, along with his fellow Americans Douglas Diamond and Phillip Dybvig, for their work on the role of central banks in preventing or managing financial crisis. The award was for research published in 1983 and 1984 that remains alarmingly relevant nearly four decades later.

Bernanke is a household name in politics and economics, having served as chairman of the Federal Reserve from 2006 to 2014. Nominated by both Presidents George W. Bush and Barack Obama, Bernanke steered the Fed through the 2008 financial crisis. Ironically, Bernanke wrote his doctoral dissertation on how the Federal Reserve deepened the Great Depression by reducing the money supply and increasing the interest rate as the stock market collapsed. As a professor at Princeton, Bernanke researched economic history, showing that liquidity in the face of toxic assets — investments that are difficult to sell — was key to preserving the banking system.

In developed economies, fractional banking is key to long-run investments in private capital such as expanding factory space or building research labs. Since these projects require billions of dollars up front, banks serve as key intermediaries by taking the comparatively smaller savings of everyday workers and channeling the funds to improve and build the economy. Unlike Scrooge McDuck, bankers do not swim in gold coins in a giant vault, but rather save a fraction of each deposit as a reserve and loan out the rest. These loans cause a chain reaction that ricochets across the financial system as businesses use the liquidity to hire workers who then place their savings in a bank that loans again and so on.

However, if the assets that investors purchased lose their value or participants in the financial system lose trust, then the entire apparatus can collapse like a house of cards. Bernanke’s research on the Great Depression showed that squabbling among individual regional bank presidents, as opposed to quick, decisive action to increase the money supply in the face of the crisis, crippled credit and increased the economic quagmire.

In the fall of 2008, Bernanke applied these lessons by reducing interest rates and then advocating for an unprecedented course. Normally, when the Fed increases the money supply, it does so by purchasing risk-free government savings bonds. This action injects cash into the financial system and lowers interest rates while keeping risk on the Fed’s balance sheet the same. Bernanke chose to purchase mortgage-backed securities instead, thus making the banking system more liquid while removing toxic assets from the market. This bold move may have backstopped collapsing asset prices and allowed markets to settle.

Bank runs, however, are psychological. If all depositors withdraw their savings at the same time, then the bank will lose its reserves quickly and close. Diamond and Dybvig showed that prevention is the best cure. If policymakers can prevent fear from spreading across the system, the angry depositors (like the Banks children) will not even show up.

Utah banker and former Fed chairman Marriner Eccles reportedly paid depositors slowly in small bills and silver dollars or drove a truck with windows lined with cash, among other strategies, to signal liquidity. However, the systematic way to signal trust is for the government to provide deposit insurance (such as FDIC). These programs reassure borrowers that their savings are safe and there is no reason to withdraw en masse.

Who should create money, how it should be used, and how to ensure its value has always fascinated humans as long as trade has existed. Central banking is a young science, but these researchers have expanded our understanding of our relationship with currency and finance in illuminating and sometimes controversial ways. Understanding the effects of monetary policy is vital for the soundness of currency, the trust we put in one another, and our relationships in an interconnected world.

Michael S. Kofoed, @mikekofoed on Twitter, is an associate professor of economics at the U.S. Military Academy and a research fellow at the Institute of Labor Economics. A Utah native, he holds degrees in economics from Weber State University and the University of Georgia. These opinions are those of the author and do not represent the U.S. Military Academy, the Department of the Army or the Department of Defense.